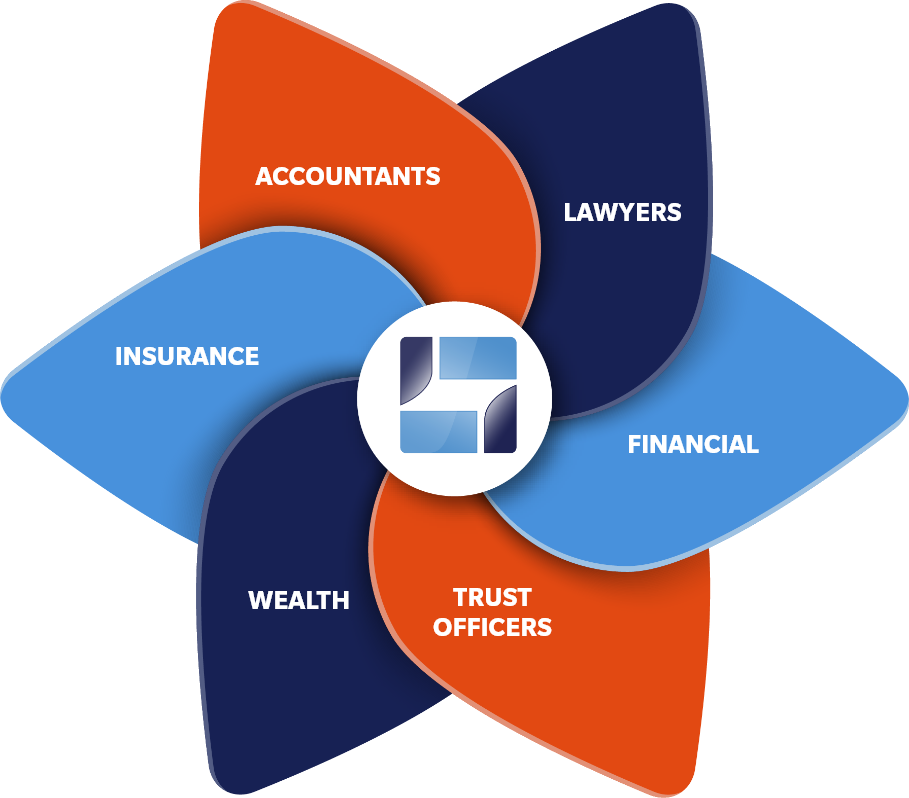

ACCOUNTANTS

- Enhance your knowledge base to meet complex planning needs.

- Master the intersection of trust and estate law with Canadian tax practices.

- Earn valuable CPD (Continuing Professional Development) hours.

- Expand your technical knowledge in estate planning.

- Tax advisors can complement their professional designation with a TEP.